Solar Updates for Homeowners

- Tax credit increased to 30% for homeowners and businesses (Previously had dropped to 27%)

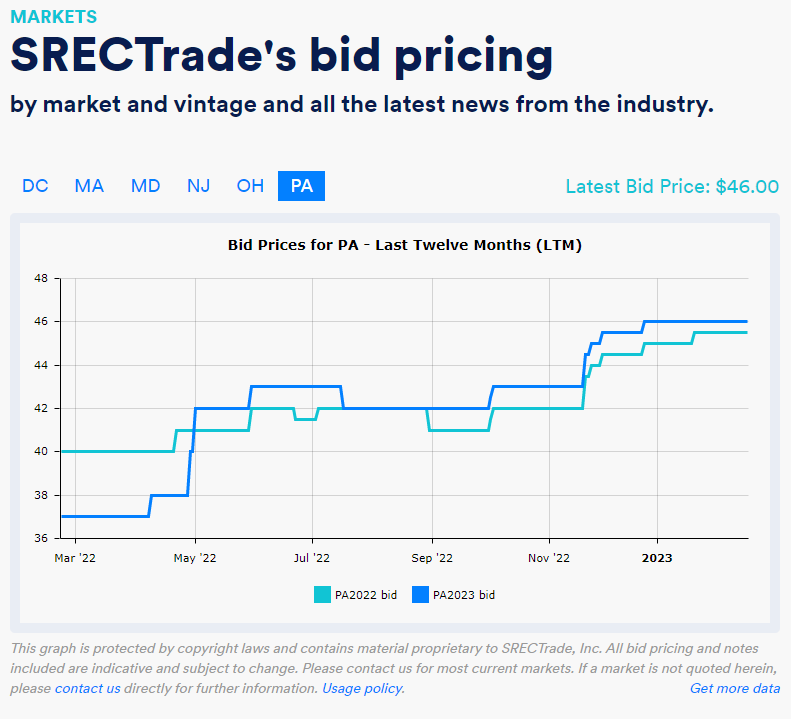

- PA SRECs are UP from $40 to $45.50 apiece and continue to rise

- Solar + Storage equipment expenses have been expanded to include all devices that have a capacity rating of 3kWh or greater

- PA has one of the strongest net energy metering policies in the country, compensating solar system owners for extra electricity generation exported to their local power grid.

Let’s take a look at the biggest changes in solar incentives and what they mean for Central Pennsylvanians:

The Federal Tax credit has been extended AND went back to 30%. Those who install a PV system between 2023 and 2032 will receive a 30% tax credit. That will decrease to 26% for systems installed in 2033 and to 22% for systems installed in 2034. Good news for our clients who installed this year and are about to file their taxes!

The solar+ energy storage equipment expenses included in the ITC have expanded. Now, energy storage devices that have a capacity rating of 3 kilowatt hours or greater are included.

According to the The Office of Energy Efficiency and Renewable Energy, the ITC will cut the cost of installing rooftop solar for a home by 30%, or more than $7,500 for an average system. By helping Americans get solar on their roofs, these tax credits will help millions more families unlock an additional average savings of $9,000 on their electricity bills over the life of the system.

Solar Incentive Updates for Businesses

- Tax credit increased to 30% for homeowners and businesses

- Additional 10% business tax credit for:

- Domestic materials

- Economic development zones (affordable housing)

- Brownfield sites

- Over $800 Million in REAP grant funding for farms and rural small businesses (over 8 times as much as before)

- Potential REAP cost share of 25-50% of project cost ex: grant funding for farms and rural small businesses that could cover up to 40% of project costs.

- PA SRECs are up from $40 to $45.50 a piece and continue to rise

- PA has one of the strongest net energy metering policies in the country, compensating solar system owners for extra electricity generation exported to their local power grid.

Remember, this is SITE DEPENDENT. Folks should reach out to us to find out which of these solar incentives apply to your site. We are still waiting on IRS guidelines for these updates and should hear more application instructions soon.

Contact us today for more info: https://www.envinity.com/contact-us/

Sounds good. Willing to do extra storage, sell back to Peco and have installation financed. When I move ( I am 82) in about three years can the new owners pick up the contract and save?