For many executives in the commercial and industrial sectors, in order for a capital project to be approved a target financial metric needs to be met. Whether it be basic economic measures or an operational related metric such as procuring a lower utility rate or reducing operating costs, many organizations need to see an impact on the bottom line before making a decision on implementation.

Historically, distributed solar power projects, owned or leased, have not been able to meet these financial goals to move a project forward.

Today, solar is an increasingly competitive investment for many commercial and industrial (C&I) business owners. When packaged with a retro-commissioning (RCx) project, the economics are too good to ignore.

A typical C&I solar project in the 100 kW to 500 kW range commonly achieves a payback of 5 to 8 years, an internal rate of return of greater than 10%, and a lower cost per kWh than what is currently being paid to the utility. For a project that has a warranty life of 25 years, solar on its own is a great investment.

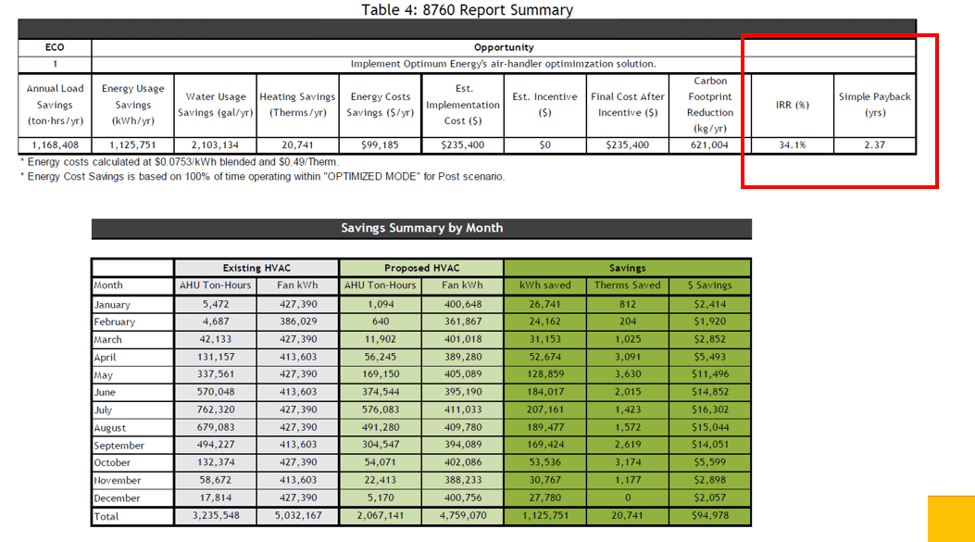

To seal the deal in the Board Room, progressive organizations are proposing that solar projects be combined with RCx projects. A typical RCx project can achieve 10% energy savings with a less than two year payback period. These projects, when performed by skilled commissioning engineers, require no investment in capital equipment, relying on the goal of making the facility mechanical systems operate the way it was designed to operate.

Two independent projects, solar and RCx, when combined into a single capital effort, more often than not far exceed the base economic metrics an executive needs to justify moving forward with a project. Let’s look at how this works in practice for an energy intensive industrial facility in Pennsylvania:

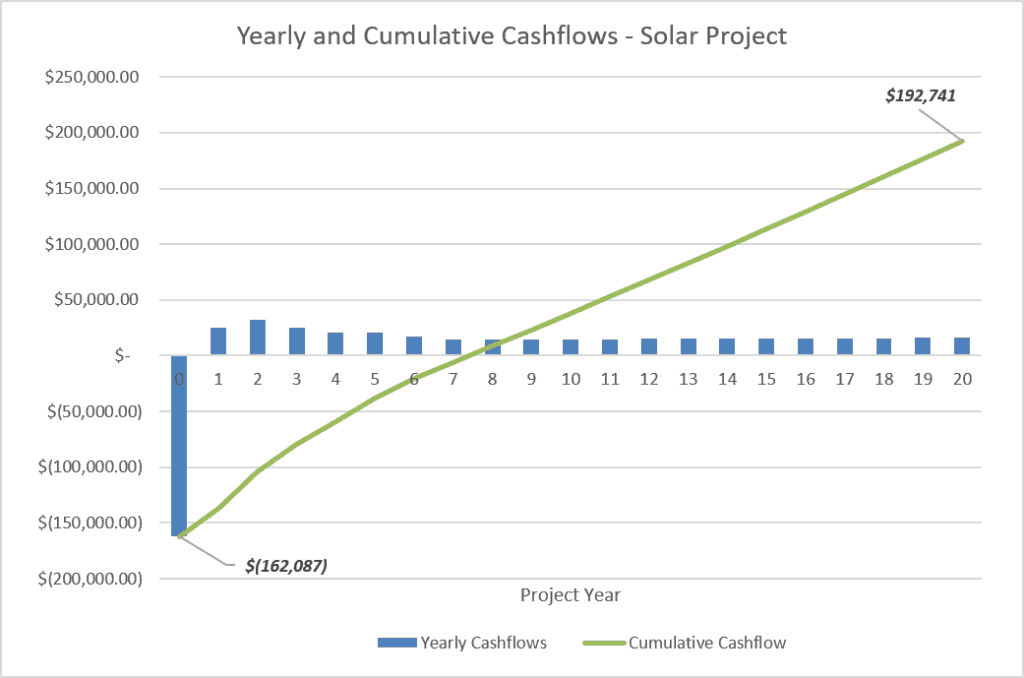

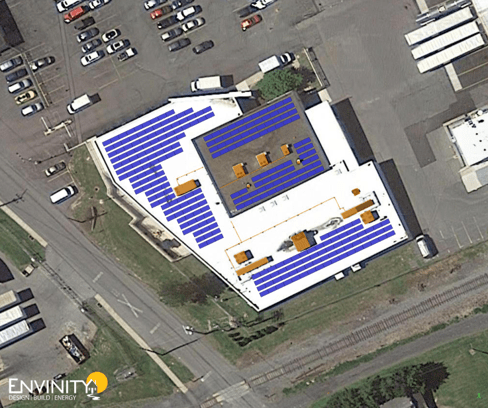

Solar Project

System Size: 106 kW

System Cost: $219,000

Financial Incentives: 26% Federal Tax Credit (-$56,950), Accelerated Asset Depreciation ($57,689)

Net System Cost: $162,000

Payback: 7.5 years

IRR: 11.4%

NPV: $152,160

Levelized Cost of Energy: $0.05/kWh

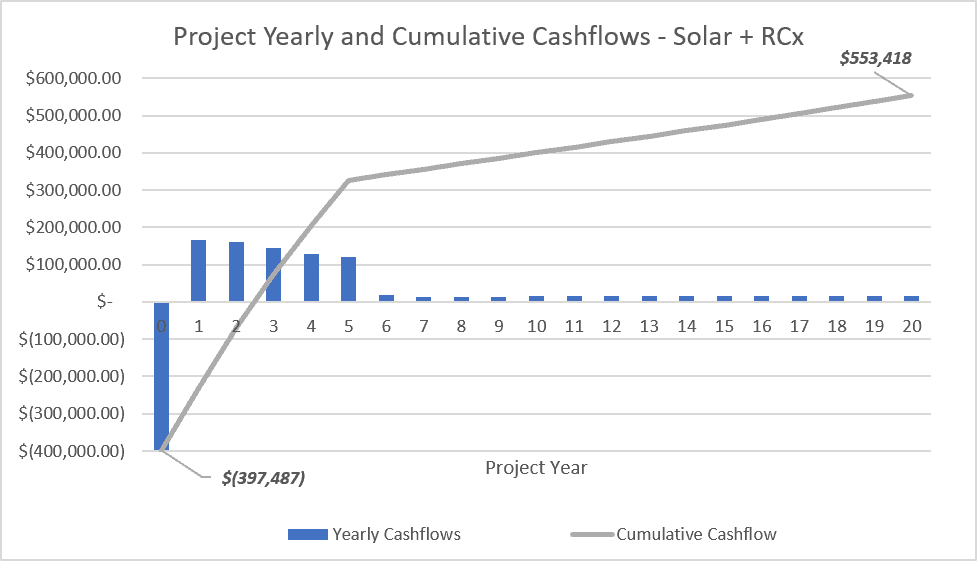

The solar project on its own may or may not be strong enough to warrant the initial capital investment. When combined with an RCx project, the results can be hard to ignore:

Net Project Cost: $397,487

Annual Energy Cost Savings: $157,000

Payback: 2.5 years

IRR: 27.8%

NPV: $424,000

The best part is that these benefits are scalable to many C&I customers – health care, school districts, office buildings, industrial, etc. You do not need to spend $1M per year on energy costs to benefit from a combined solar and RCx project, nor do you need to have an ‘older’ building. In fact, our greatest energy saving successes with RCx are with newer buildings.

If you want to do good for the environment AND make a splash with management, consider exploring a joint solar power and RCx project. Envinity has all of the resources you need to be an energy champion of your organization.

More examples of Solar on it’s own versus Solar + RCx:

For the Energy and Finance Nerds among us:

Learn more on this thrilling topic at the Pennsylvania Technical Assistance Program (PennTap) Building Re-tuning and Operations Conference March 3rd at the Nittany Lion Inn.

Reserve your spot HERE

Recent Comments